What will a shift between Ben Bernanke and Janet Yellen leading the Federal Reserve mean for the economy? Most people are saying it won’t change much. I’m a senior economics major at IUP, so here is a quick rundown of the situation at the Federal Reserve:

What the Federal Reserve does

The federal reserve creates money by buying and selling bonds with banks. We all know that the government prints the money, right? The Reserve’s job is to get that money into the economy so it can circulate and generate value. Money sitting in a Reserve vault is not really money, because it can’t be used for transactions. Think of the Federal reserve vault as a magical place where money is temporarily made into worthless paper. To give money value by getting it out of the vault, the Reserve spends it by buying bonds from banks. The banks loan this money they receive from selling bonds out to people, who use it to buy stuff.

To take money out of the economy the Reserve sells bonds to the banks. In other words, it exchanges a bond for money. That takes money from the banks and puts it back into the federal reserve vault where it ceases to be money any more.

The Reserve adjusts the amount of money in circulation like this in order to control interest rates and inflation in order to increase productivity so that the economy can grow and hopefully increase our standard of living.

Quantitative Easing vs Tapering

Quantitative easing is when the central bank puts more money into the economy. This is sometimes done in response to an economic downturn, like the crash of 2008. A recession makes people spend less money, out of fear for their own income decreasing. If you aren’t sure if you might get laid off next month you might start saving more money, right? Quantitative easing is an attempt to counter that effect, because if nobody spends money then we all get laid off and you have people starving in the streets.

Doesn’t putting more money into circulation create more inflation? Yes, it does. Inflation is not as bad as you might think, though. Inflation makes people spend money, and spending money is good. If people don’t spend money we all suffer. Think about it like this: If you have $100 in your bank account today you can buy $100 worth of goods with it today. If you save it and spend it in 6 months then you will be able to buy less than $100 worth of goods when you spend it, because of inflation. Inflation makes it make sense to spend the money rather than save it. This puts more money into the hands of business owners, who have the same motive to spend rather than save.

Taking money out of circulation creates deflation, which has the opposite effect. If you have $100 in your account but know that in 6 months you can buy $150 worth of goods with it then you have incentive to save as much as you can and spend less. This gives businesses less money, because people are spending less, so they can’t hire as much. This also creates havoc in the financial markets, since banks end up getting less money than they loaned out.

That is why we keep a low inflation rate. It makes people spend but our inflation rate isn’t enough to completely discourage all saving.

Since the crash of 2008 the Federal Reserve has been putting more money into the economy to try to get people to spend more. Now they want to taper their quantitative easing.

To taper quantitative easing means to keep putting more money into the economy, but to increase the money supply at a slower rate, to cool down inflation. This would normally mean that the recession is over and we don’t need the government to encourage us to spend more money any more. The problem is that many people are not convinced that the economy has recovered enough to cut back on increasing the money supply.

Velocity of Money

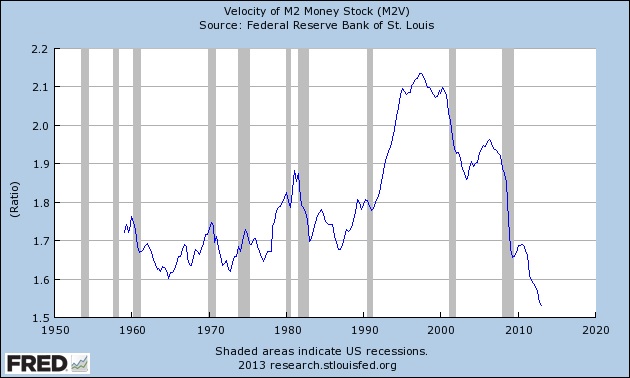

Velocity of money is an extremely important metric in all of this. Velocity of money measures how many times a dollar circulates in the economy in a year.

Think about what happens when you get your pay check:

- You save some of it and pay your bills with some of it and go out for dinner and a movie with some of it. So lets say you get a hot dog at a stand outside the movie theater.

- That money goes to the hot dog vendor and he goes home and spends it on his cable bill, to pay Comcast.

- Comcast uses that money to pay out a class action settlement against them.

- The class action recipient spends that money on a t-shirt.

- The retailer who sold that t-shirt spends that money on a celebrity endorsement.

- The celebrity gives that money to his financial adviser to manage, who puts it in the stock market.

That dollar you spent at the hot dog stand then ends up in the financial system, where it transfers power between rich people but doesn’t actually stimulate much productivity. That dollar just circulated through the economy 6 times, so the velocity of that dollar is 6.

When we look at macroeconomics, we are looking at the average velocity of money for all dollars in a given year. If velocity of money is 1.5 then every dollar created is spent 1.5 times in a year. If the velocity of money is 0.5 then only half of the dollars created circulate even once in the economy in a year.

Low velocity of money is bad, because with low velocity of money people aren’t spending, which means that people aren’t earning, so people aren’t being as productive as they could be. Unemployment increases when velocity of money is too low.

Since the great recession of 2008 the velocity of money in America has been crashing. We are currently at a 5 decade low for velocity of money. That means that we have not yet recovered, because people aren’t spending enough money. Why would we want to taper quantitative easing if we haven’t recovered yet? That’s kind of the big question right now.

What I think

I think that what the Fed is doing is testing the waters. They have been pumping more and more money into the economy for 5 years now and we still aren’t really recovering as much as we should be as a result of that. Unemployment is still over 7%. Inflation is not a problem. Inflation is still at historical lows, so they can put a lot more money into the economy without creating massive inflation. The problem is that the Fed is loosing confidence that putting more money into the economy is solving the problem. They worry that continuing to put this much money into the economy might have some kind of delayed effect, where people aren’t spending much and then all of a sudden everybody realizes that they have all this money and they all go out to spend money all at once and create massive hyper inflation, which could cause another recession.

The Fed isn’t going to stop increasing the money supply. They are just going to slow down the rate at which they are increasing the money supply. Instead of putting $100 billion out a month they might put out $90 billion dollars, just to see how the economy responds. Does this cause higher or lower unemployment? They are experimenting in order to try to get the most productivity they can out of the economy.

Ben Bernanke

Bernanke is the current chair of the Federal Reserve, and he is set to step down soon. He has always understood the effects of the velocity of money. He got the nickname ‘Helicopter Ben’ for writing a paper that examines what the effects of dumping cash over south central LA might be, because giving money to banks creates less velocity than giving money to individuals. He has been calling the shots at the federal reserve for the last 8 years. Tapering is his idea.

Janet Yellen

Yellen has been the vice chairwoman under Bernanke since 2010, so she won’t be changing direction sharply. By the same token, she specializes in unemployment economics and believes that low inflation can hurt the economy as much as high inflation. Her ideas are along the lines of Paul Krugman’s ideas. Any changes in direction she makes will probably move towards increasing inflation in order to increase velocity, create more jobs and increase productivity.

Of course, the politics of approving an Obama nominee will be absurd. I expect the Republicans to act like babies during the process, with no regard at all for the weak economy.